NFTs: Revolutionizing Real Estate

- Jul 23, 2024

- 2 min read

NFTs (Non-Fungible Tokens) are revolutionizing the real estate sector, offering innovative ways to perceive and interact with both virtual and physical properties.

Understanding NFTs

NFTs are unique digital assets authenticated through blockchain technology. Unlike cryptocurrencies, which are fungible, NFTs represent one-of-a-kind items. This uniqueness and verifiability make NFTs ideal for property transactions.

NFTs in Virtual Real Estate

Virtual real estate platforms like Decentraland and The Sandbox allow users to buy, sell, and develop land using NFTs. These platforms create digital worlds where properties are limited, driving up their value. Owners can monetize their virtual properties through leasing, advertising, or creating virtual experiences.

Enhancing Physical Real Estate with NFTs

NFTs are transforming physical real estate transactions by providing a secure and transparent way to record ownership and transfer properties. Tokenizing physical real estate involves creating an NFT that represents a share or full ownership of a property. This process can streamline transactions, reduce fraud, and increase liquidity in the real estate market.

Fractional Ownership and Investment

NFTs enable fractional ownership, allowing multiple investors to own a portion of a property. This democratizes real estate investment, making it accessible to a broader audience. Investors can trade their shares on secondary markets, enhancing liquidity and flexibility.

Smart Contracts and Automated Transactions

NFTs utilize smart contracts, which are self-executing contracts with the terms directly written into code. These smart contracts can automate various aspects of real estate transactions, from transferring ownership to managing rental agreements. This reduces the need for intermediaries, lowering costs and increasing efficiency.

Decentralized Real Estate Platforms

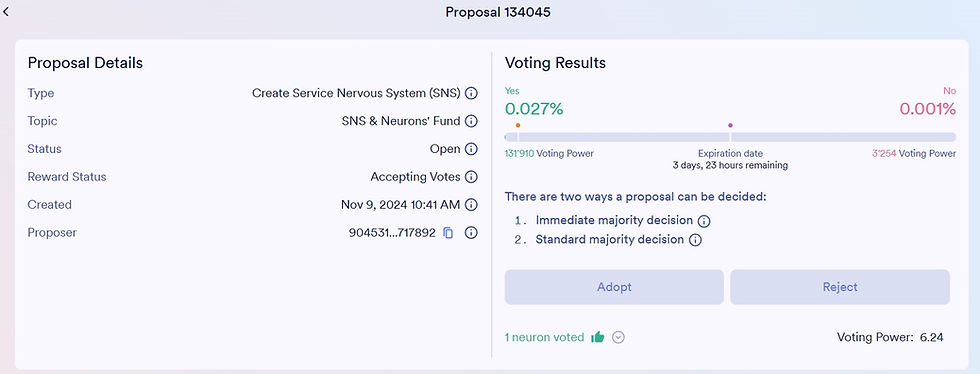

Decentralized platforms, organized through DAOs (Decentralized Autonomous Organizations), are emerging to manage NFT-based real estate. These platforms offer transparent governance and decision-making processes, ensuring fair and equitable management of properties. DAOs can also facilitate community-driven development projects, enhancing the value and functionality of real estate assets.

Challenges and Future Prospects

While NFTs offer numerous benefits, challenges such as regulatory uncertainty, technological barriers, and market volatility remain. However, as blockchain technology matures and regulations evolve, the adoption of NFTs in real estate is expected to grow. Future advancements could see more seamless integration of NFTs into traditional real estate markets, further transforming the industry.

Conclusion

NFTs are powerful tools reshaping the real estate landscape. From virtual properties to physical real estate, NFTs provide new opportunities for ownership, investment, and interaction. As the technology and market continue to evolve, NFTs are set to play an increasingly significant role in the real estate sector.

Comments